GameStop Stock Crash: What You Need To Know

A lot of controversy has risen over stocks during these past couple months.

February 28, 2021

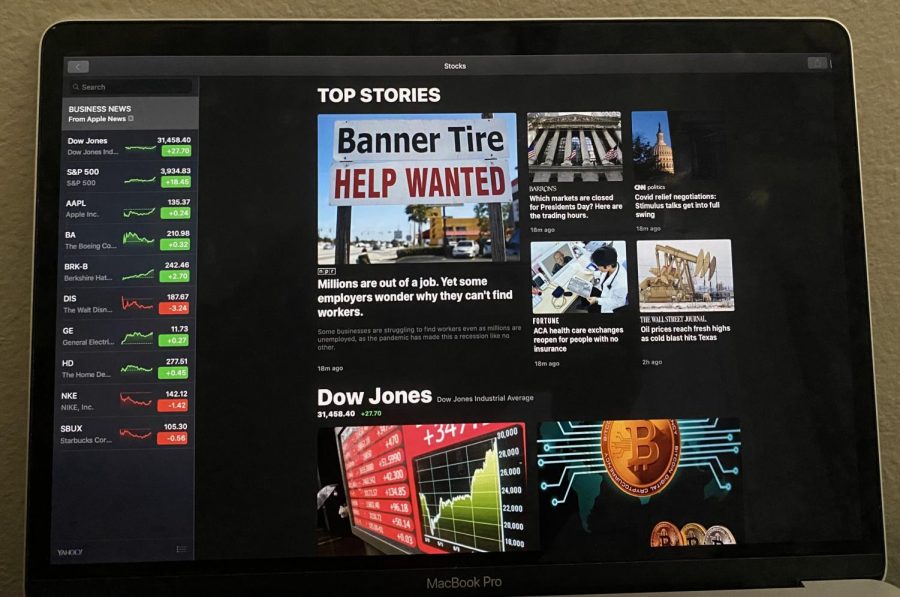

Many of today’s adults spent their younger years in GameStop stores. They lined up for console launches. They bought and sold games there too. Now some of those gamers are rich after buying GameStop’s stock and encouraging their friends on Reddit to buy it as well. GameStop’s shares rocketed higher than ever expected in the past couple of weeks, and all because activity among social media investors began pushing it up. Wall Street had bet heavily that the company would fail, but as the price kept going up, investors were forced to reset their wagers. That led the stock to rocket up and then swing wildly. GameStop shares along with AMC shares dipped February 4th amid high-level meetings to discuss recent trading convulsions and as Reddit users argued furiously on the now-infamous WallStreetBets chatroom about whether to fold or fight. GameStop shares are now down 34%, and AMC Entertainment has slipped 19%Other stocks that were vigorously promoted on WallStreetBets starting last week are mostly lower as the broader market posted gains. AMC and more have raised questions about market manipulation, and who is allowed to do it. Spurred criticisms by lawmakers and other investors over some trading platforms’ decisions to help limit trading of the stocks. Others have raised questions over who, exactly, is even driving the stock action at this point.

Treasury Secretary Janet Yellen was set to meet with officials from the Securities and Exchange Commission, the Federal Reserve, the New York Fed, and the Commodity Futures Trading Commission about the crash.

“We really need to make sure that our financial markets are functioning properly … and that investors are protected,” Yellen said.

During GameStop rallies, larger investors, including some hedge funds, had placed short bets on GameStop stock, or a bet that it would fall. But smaller individual investors, encouraged by the Reddit board WallStreetBets, rushed into GME stock. That sent the stock’s price soaring, forcing short sellers to scramble to cover their losses, which squeezed the price even higher. Some observers have said that any retail uprising was unlikely to break bigger firms’ grip on the market. A platform used by investors for trade by the name of Robinhood was surely the cause of this big outburst.

Robinhood, a few days ago rolled back restrictions on purchases of shares in the companies, when traders could buy up to 100 shares of GameStop and 1,250 shares of AMC. The previous limit was set at 20 shares for GameStop and 350 for AMC. Robinhood has previously said it had to block purchases to meet a tenfold increase in deposit requirements mandated by clearinghouses registered with the Securities and Exchange Commission. Lawmakers and investors heavily scrutinized Robinhood’s decision to impose trading limits.

Robinhood’s lawsuit comes from the U.S. District Court Southern District New York and says that the company is in violation of multiple free-trade regulations. The larger firms are upset about the funds they lost by being outmaneuvered on the open stock market by a sizable group of individual buyers, whose community has gained a reputation for being a “volatile” online group. The battle is far from over and some analysts even believe that this might save the dying retailer GameStop from total annihilation. However, This isn’t the first time that Robinhood got into some trouble. The company previously paid a $65 million fine for misleading users about its revenue sources. It’s also faced questions about whether it does enough to educate young users about the potential risks of day trading. Robinhood has stated that the restrictions held on GameStop and AMC would only go away over time but not go away completely.